Distribution of your gross salary income in Pakistan

According to the Income Tax Ordinance 2001, the salary you receive at home each year is subject to the following divisions.

Basic salary

- House Rent Allowance (HRA).

- Convenience Allowance.

- Medical and other allowances.

- Basic salary

A large part of your home pay is your basic salary. This is a fixed amount that you can receive without any additional payments or deductions. It does not include any allowances, commissions, bonuses, or overtime pay.

House Rent Allowance:

The House Rent Allowance (HRA) makes up a certain percentage of your total salary. This is determined by the amount of your home rent. Typically, a home rent allowance is about 40 to 50 percent of your basic salary.

On a basic salary of PKR 30,000, you can get a house rent allowance between PKR 12,000 and PKR 15,000. The HRA percentage may also vary from organization to organization.

Convention Allowance:

Even in today's world, when a large segment of the working class is using online platforms, people need to go to work on a regular basis. About 10-15% of the household wages they take to cover their future expenses are allocated for the Convenience Allowance. for example,

if you are earning PKR 50,000 per month, this amount will include a convenience allowance of around PKR 5,000 to 7,000.

Medical and other allowances:

Depending on the nature of your employment, medical allowance may or may not be part of your home pay. Companies offered medical allowance separately. The same is true of other types of allowances such as entertainment allowance, travel allowance and fuel allowance. In Pakistan, as in other countries, the distribution of your gross salary income depends a lot on your role and position in a particular organization.

According to the Income Tax Ordinance 2001, income tax is levied on the total amount of your total salary.

INCOME TAX SLAB RATES IN PAKISTAN FOR FISCAL YEAR 2021-22:

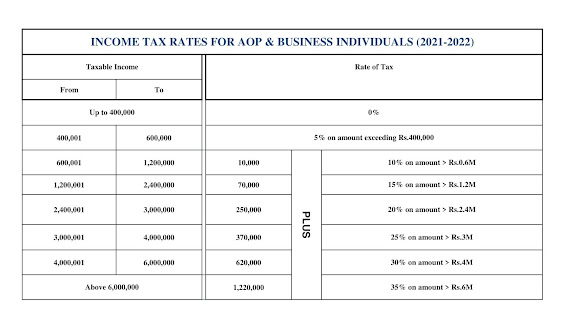

INCOME TAX RATES FOR AOP & BUSINESS INDIVIDUALS (2021-2022):

INCOME TAX RATES FOR COMPANIES (2021-2022):

0 Comments